MetSpace London : Sports Business Success Lies Behind Closed Doors

In a landscape where sporting success drives economic growth, Robert Schogger, co-Founder and CEO of MetSpace, highlights the crucial behind-the-scenes infrastructure that empowers teams to triumph and positions businesses to thrive.

Ice Cream Alliance : A Taste of Tradition, a Scoop of Tomorrow

The delicious and fascinating realm of European ice cream production is evolving at pace alongside shifting consumer priorities and tastes. We get the latest scoop from Catherine McNeil, Director of Operations, the Ice Cream Alliance.

BBD Perfect Storm : The New Heights of Luxury

Airports are evolving into sophisticated retail destinations, providing brands with opportunities to engage high-value customers. Natalie Reid, Head of Loyalty at BBD Perfect Storm, explores how curated airport experiences are redefining the travel journey.

Why Business Leaders Should Feel No Shame in Being a One Trick Pony

David Milner, Executive Chairman of pizza titan Crosta Mollica, discusses his journey to success in the food and beverage industry and how aspiring entrepreneurs can utilise their niche skillset to their advantage.

Biffa : Easing EPR Challenges

Claire Davies, Head of Producer Compliance at Biffa, discusses the impact of recent extended producer responsibility legislation and how businesses can address these updates with confidence and save money in the long run.

AppsFlyer : Loyalty is Everything

Sue Azari, eCommerce Industry Lead at mobile attribution and marketing analytics platform, AppsFlyer, discusses the integration of loyalty programmes as a cornerstone strategy within today’s retail landscape.

FarmERP : Transforming Agricultural Value Chains

CEO and co-Founder of FarmERP, Sanjay Borkar, discusses the integration of innovative new technology that is driving the transformation of agriculture into a more efficient and sustainable entity.

FarmERP : Implementing Agriculture 4.0

Sanjay Borkar, CEO and co-Founder of FarmERP, discusses the challenges and opportunities of implementing Agriculture 4.0 in the Middle East and Europe.

Brand Finance : The Global Rise of Middle Eastern Brands

Savio D’Souza, Director of Brand Finance, highlights how the forward-thinking brand strategies of Middle Eastern organisations across healthcare, telecommunications, and wealth management sectors are elevating the region’s international market positioning.

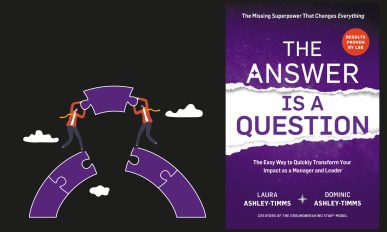

A New Approach : Helping Leaders Navigate Today’s Business Challenges

Dominic Ashley-Timms, CEO of performance consultancy Notion, assesses the growing disconnect between today’s business leaders and their employees and explores the feasibility of implementing a new management model to cultivate a healthier workplace.

Culture First Recruitment : Creating a Human-Centric Workplace

The true meaning of workplace culture, as seen through the eyes of Dubai employee expert Ryan Jackson, CEO of Culture First Recruitment.

RedCloud : Reconstructing the Food Chain

Juandre de Jong, Senior Vice President of Products at RedCloud, discusses the multifaceted nature of the global food supply chain and how technology is making revolutionary changes by streamlining and equalising the vast industry.