Accessible at the swipe of a finger, we explore the technological progression of mobile banking and mobile payments in Europe.

EUROPE’S MOBILE BANKING EVOLUTION

Almost anything is possible with a smartphone these days, and banking is no exception.

In Europe, where mobile banking is of widespread popularity, customers can shop, pay utility bills, and even send money to friends or family in seconds straight from their mobile device.

The market is alive with mobile banking apps from some of the biggest players in the industry, including Apple, Google, and Samsung, whilst digital banks such as Monzo, Revolut and Starling Bank allow people to track their spending from their digital device.

A RISING TREND

Mobile banking is a rising trend and one of the most popular payment methods in Europe, correlating with the fact that people are spending a lot more time on their mobile phones.

It is already the most popular method of banking in the UK and there has been particularly strong online banking penetration across Scandinavia.

Meanwhile, central European countries such as Germany and Austria are experiencing a significant reduction in the use of physical cash, a reflection of mobile banking as a cultural evolution as well as a technological one.

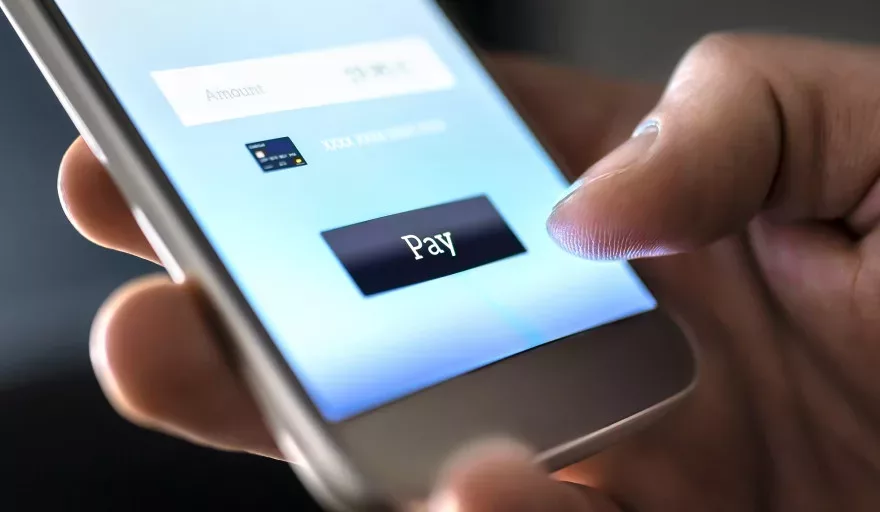

Naturally, at just a tap of a screen away, mobile banking transactions are much faster and a lot more convenient than traditional means, without the need to queue at branches, visit cash machines, rummage through wallets or keep track of physical cash.

Services are also accessible at any time, rather than only during working hours, and with so many payment and banking app options out there, customers have a broad variety of brands to choose from.

Not only does this give rise to more products and services, but on top of this smaller, independent banking service providers also have the opportunity to be a unique alternative for customers looking to bank with a less-established name on the market.

Convenience is one thing, but mobile banking has also proven itself to be extremely safe and secure, increasing European confidence in online payments as a result.

As well as being heavily encrypted, smartphone payment systems often make use of ultra-safe biometric verification tools such as fingerprint identification, which are more secure than traditional methods such as PIN codes.

MOBILE BANKING AND THE NEW NORMAL

From video conferencing and online shopping to remote education, digital platforms are booming in Europe as the COVID-19 pandemic continues to evolve.

According to studies by Mastercard, COVID-19 has also driven Europeans into becoming more tech-savvy when it comes to banking.

The rapid digitalisation of life under lockdown accelerated interest in digital banking solutions and apps across Europe, as the continent adapted to restrictions implemented due to the pandemic.

Online activity and the mass adoption of digital banking surged as a result, with consumers gravitating to remote services to access their funds and securely, quickly and conveniently manage their personal finances.

Mastercard’s Evolution of Banking study revealed a heightened appetite for online solutions across 12 European markets, with 62 percent of respondents interested in switching to digital platforms in 2020.

As lockdown restrictions limited access to physical banks for a period of time, the majority of Europeans have explored new banking solutions. Of over 9,600 Europeans surveyed, just under half (46 percent) responded with a high interest in new digital banking solutions.

42 percent of Europeans now conduct financial transactions online or via an app more frequently than prior to the pandemic, citing timesaving and simplicity benefits.

The Evolution of Banking study also indicates that European priorities are shifting when it comes to the attributes consumers want from their online banking and mobile payment solutions, with an increasing importance being placed on the availability, lifestyle attributes and cost-effectiveness of digital platforms.

Despite the year-on-year growth of digital and mobile banking adoption, physical banks and financial institutions remain trusted by many. The significant majority of Europeans still believe that physical banks will exist in their country in 10 years’ time.

With many traditional banks increasingly offering digital solutions, however, mobile banking clearly remains a strong reason behind consumer retention and confidence.